Industry Overview

Samuel Taylor, Vice President of RaboResearch North America spoke about upcoming trends and the state of agriculture in 2021 at the 2021 Virtual CAAR Conference in February.

“What we have seen in the North American market is a laddered impact of effects, changing the psyche and the dynamic of the farmer over the last 6 months.” Said Taylor, “What we have seen in many geographies is a mindset shift from a low commodity price dynamic across the globe, to farmers really looking to maximize their return on investment of inputs.”

Taylor is part of a global research team composed of over 80 professionals in 9 countries positioned across the full finance and accounting value chain. His personal research team specializes in farm inputs such as seed, chemicals and fertilizers, and has positions in all the main global markets.

North American Markets

The North American market has seen a large number of both disruptors and incumbents pushing into the e-commerce segment, requiring increased adoption of new technologies in order to be competitive with changing demand structures. In addition to this, North America has seen a splitting of farm sizes, with an increasing number of farms in the 1-50 acre and 2,000+ acre categories. This is a result of larger farms being able to develop efficiencies and economies of scale that allow them to weather periods of low commodity prices and regulatory issues. Medium-sized farms lack the economies of scale that large farms can achieve, and also require more maintenance than many small farms, making it difficult for these 51-1,999 acre farms to function effectively.

“Across the globe, we see a consolidation of farms, with average farm sizes increasing. This will have a profound impact on the purchasing power that these enterprises have through the retail channel.” Said Taylor, “It also changes the type of enterprising entity that they are as well, and we believe that long-term trajectory for commodity prices is down to that low-margin environment.”

Overseas

The Asian market has seen nearly the opposite of what is happening in North America, with large e-commerce companies such as Alibaba increasingly pushing into the retail space, and structural changes in the Chinese market also contributing to higher commodity prices? Other insights include noting that the European market has been less progressive than North America, seeing less new product launches and innovations, as well as shortages of DAP and MAP fertilizers in Australia as supply chains shift product towards the North American markets.

Regulation and Subsidies

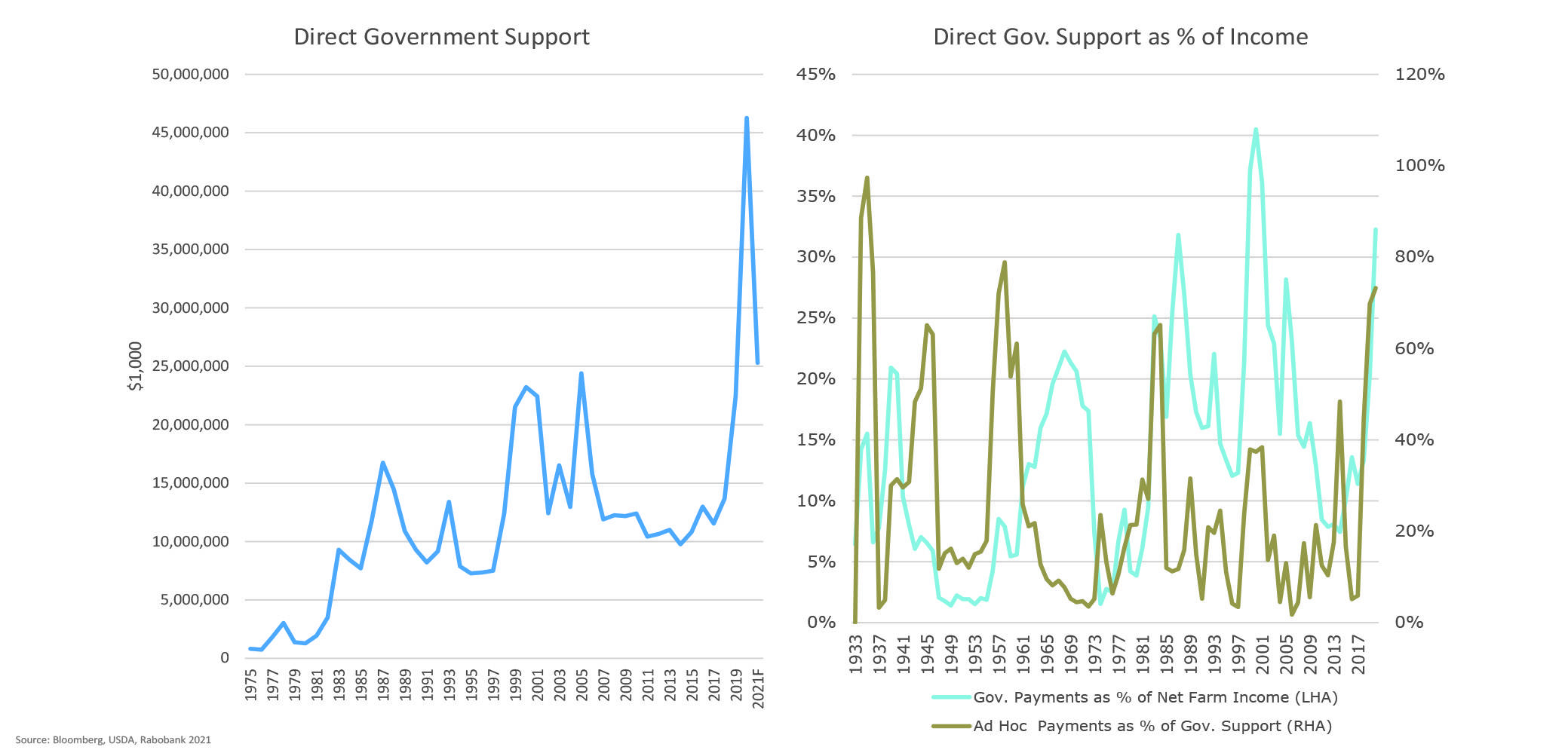

Government subsidies and grants have seen a dramatic increase over the past year, due to factors such as the COVID-19 pandemic increasing ad hoc support for many farms. While this support is beneficial in the short term, it creates volatility in the commodity market that slows the consolidation of farms that is projected in the long run.

The long-term trajectory for commodity prices is a reversion back to the mean. We’ve been in a cyclical low commodity price environment, and without government support, we would see some farmers squeezed out of production. The introduction of government support slows consolidations, but we still foresee that change coming in the future.

Trends to Watch

Over the short term, rallies in commodity prices have, in large part, been driven by a mindset shift in many farmers as they look to maximize their yields and their return on investment of inputs. This is due to the increased adoption of new AgTech innovations that increase yields, farmers searching for more expensive and desirable traits in their crops, as well as subsidies creating volatility in the market.

There is also an increasing amount of investment in infrastructure and precision ag, forecasting farmers returning to an ROI mindset. Precision farming technologies have the potential to lower long-term demand structures as margins become tighter because of increased utilization. Higher commodity prices may also lead to farmers investing more in inputs such as seeds and fertilizers.

Long-term trends towards sustainable farming practices, changing consumer demands and government mandates have already been felt in North American markets. California’s Proposition 12 regulates animal welfare, including cage-free eggs and sow housing mandates that will change how farms must operate to sell into the California market. This has impacts on greenhouse gas emissions, antibiotic regulations, food waste, and even workplace safety and worker rights, asking the question of whether supply chains can keep up with regulatory dynamics.

Despite this, new technologies have the potential to revolutionize the farming world, with new supramolecular, nanotechnologies, and breeding techniques dramatically increasing yields by up to 20%. Moving into the future, we may even see taxpayers pushing back against government subsidization of agriculture, the consumer may increasingly push for things such as increased prices for low-carbon production.

Taylor concluded by saying, “I believe that there is a social contract between the farmer and consumer that needs to be enhanced, and I think that they should both start appreciating each other a little bit more.”